Flash BTC Transaction take 10-60 minutes to confirm on the blockchain network. This delay frustrates users who need quick trading or time-sensitive transactions.

Flash BTC Transaction technology provides a solution to this challenge. This innovative approach makes Bitcoin transfers faster. The piece explains the core mechanisms behind this technology and shows you the steps to execute these transactions. You will learn about potential risks and the current legal framework that governs this technology.

The content helps you understand how to perform Flash BTC transactions safely. You will discover their impact on the cryptocurrency ecosystem and what to think about before you begin.

Understanding Flash BTC Transactions

The mechanics of Flash BTC transactions work quite differently from regular Bitcoin transfers. This innovative service operates outside the usual blockchain framework and allows Bitcoin transfers to happen almost instantly [1].

Flash BTC transactions create private keys that link to existing Bitcoin amounts in a wallet [1]. The system works off-chain, which means these transactions don’t need the standard blockchain verification process [1].

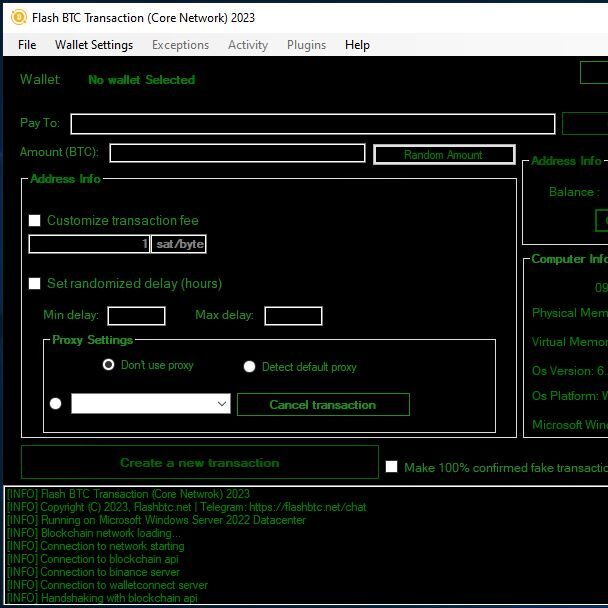

Regular Bitcoin networks can handle about 4-4.5 transactions every second [2]. Flash BTC transactions process by a lot faster because they work outside this traditional system. Here’s what makes this speed possible:

- Instant execution without blockchain confirmations

- Off-chain transaction processing

- Specialized activation codes for access

- No mining verification requirement

Flash BTC transactions need specific tools to work properly. Users must have an activation code – known as a “flashbtc activation code” or “coinceller activation code” [1]. This code lets users perform quick transfers without waiting for the usual block confirmation times [1].

The main difference shows up in the processing method. Traditional Bitcoin transactions wait while miners verify and add data to a block. Flash BTC transactions skip this process entirely [1]. This smart approach enables almost immediate transfers, which helps a lot when time matters most.

Security Implications and Risks

Security issues with Flash BTC transactions need immediate attention because the cryptocurrency space has lost substantial money through various vulnerabilities. Crypto hack losses shot up by 900% in Q2 of 2024, and stolen funds reached USD 1.40 billion [3].

Flash BTC transactions expose users to several major risks:

- Smart Contract Vulnerabilities: Attackers can exploit code to steal funds and gain unauthorized access [4]

- Price Manipulation: Bad actors use flash transactions to manipulate asset values artificially [4]

- Technical Failures: Network problems can stop or invalidate transactions [5]

- Oracle Dependencies: Wrong price feeds can get pricey and cause errors [5]

Attackers now target DeFi protocols more frequently, especially when they see chances to manipulate prices and exploit liquidity pools [3]. The Lazarus Group stole about USD 600 million in cryptocurrency throughout 2023 [3].

Phishing remains the biggest threat. Attackers try to get private keys and wallet credentials through clever social engineering [6]. These attacks look real and become dangerous especially when you have users who don’t know much about security protocols.

The blockchain doesn’t let anyone fix transaction errors once they go through [7]. Users must understand that Flash BTC transaction mistakes stay permanent and can’t be reversed. Hardware wallets and strong security measures protect assets better because keeping private keys online makes them easy targets for attacks [7].

Legal and Regulatory Framework

Financial authorities continue to shape the regulatory environment for Flash BTC transactions by creating complete frameworks. Financial regulators, especially the SEC and CFTC, have stepped up their oversight of digital asset transactions [8].

Regulatory actions for digital assets in the United States jumped by more than 50% from 2022 to 2023 [8]. Digital asset cases now make up almost half of the CFTC’s total enforcement actions [8].

The core compliance requirements we need to think about include:

- Registration with appropriate regulatory bodies

- Implementation of resilient AML/CFT controls

- Regular transaction reporting

- Customer identification procedures

- Record keeping for 7 years [9]

Cross-border regulations pose unique challenges, especially when cryptocurrency transactions must follow rules across multiple jurisdictions [10]. Tax obligations and reporting requirements add layers of complexity to compliance.

Flash transactions remain legal [11], but they need careful attention to stay compliant with regulations. The FBI has warned about potential misuse [11]. This makes proper documentation and protocol adherence vital for our operations.

Tax regulations for cryptocurrency differ by a lot between jurisdictions [10]. Teams must track and report transactions based on local requirements carefully. Missing these requirements can lead to heavy penalties [10].

Conclusion

Flash BTC transactions are faster than traditional Bitcoin transfers because they use an innovative off-chain processing mechanism. This piece gives you the knowledge you need to execute these transactions safely and highlights significant security measures you should take.

Let’s look at the most important points we covered. Flash BTC transactions work through off-chain processing – that’s the basic mechanics. Smart contract vulnerabilities and price manipulation are major security risks you need to watch for. Different jurisdictions have their own regulatory requirements. You also need proper transaction reporting and documentation to stay compliant.

Your security should be the top priority with Flash BTC transactions. Blockchain transactions cannot be reversed, and cryptocurrency theft is on the rise. You need to pay close attention to protective measures. If you want to learn more about Flash BTC implementations, visit www.realflashbtc.net for detailed information.

The cryptocurrency landscape keeps changing as regulators worldwide create better frameworks for digital asset transactions. Flash BTC technology offers great benefits but comes with risks that need careful handling. To succeed with these transactions, you must balance speed advantages with security protocols and strict regulatory compliance.

FAQs

Q1. What is a Flash BTC transaction and how does it differ from a regular Bitcoin transaction? A Flash BTC transaction is an innovative method that allows for near-instantaneous Bitcoin transfers by operating off-chain. Unlike regular Bitcoin transactions that require blockchain confirmations, Flash BTC transactions bypass the standard verification process, enabling much faster processing times.

Q2. Are Flash BTC transactions secure? While Flash BTC transactions offer speed advantages, they come with security risks. These include smart contract vulnerabilities, price manipulation threats, and technical failures. Users should be aware of these risks and implement robust security measures, such as using hardware wallets and being cautious of phishing attempts.

Q3. What do I need to execute a Flash BTC transaction? To execute a Flash BTC transaction, you need specialized tools designed for Flash BTC functionality. These typically require an activation code, often referred to as a “flashbtc activation code” or “coinceller activation code,” which provides access rights to conduct rapid transfers.

Q4. What are the legal implications of using Flash BTC transactions? Flash BTC transactions, while legal, are subject to increasing regulatory scrutiny. Users must comply with registration requirements, implement AML/CFT controls, and adhere to reporting and record-keeping obligations. It’s crucial to understand and follow the regulatory framework in your jurisdiction.

Q5. Can Flash BTC transactions be reversed or corrected if a mistake is made? No, Flash BTC transactions, like all blockchain transactions, are irreversible once executed. The immutable nature of the blockchain means that any errors cannot be corrected. This characteristic underscores the importance of double-checking transaction details before confirming.

References

[1] – https://realflashbtc.net/articles/2024/08/07/flash-bitcoin-software/

[2] – https://realflashbtc.net/articles/2024/08/08/flash-btc-explained-in-depth-guide-to-the-cryptocurrency/

[3] – https://realflashbtc.net/articles/2024/08/09/is-flash-bitcoin-tradable/

[4] – https://realflashbtc.net/articles/2024/08/10/how-to-use-flash-btc-a-complete-guidance-for-beginners/

[5] – https://realflashbtc.net/articles/2024/08/12/flash-btc-vs-cryptocurrencies-speed-security-usability/

[6] – https://realflashbtc.net/articles/2024/08/14/flash-btc-software-2024/

[7] – https://realflashbtc.net/articles/2024/08/15/understanding-btc-flash-transactions-usdt-comparison/

Good