Flash BTC software has an amazing capability. It can generate fully confirmed Bitcoin transactions that stay active on the network for up to 120 days. This technology has sparked much interest about how these systems work.

Flash BTC software has an amazing capability. It can generate fully confirmed Bitcoin transactions that stay active on the network for up to 120 days. This technology has sparked much interest about how these systems work.

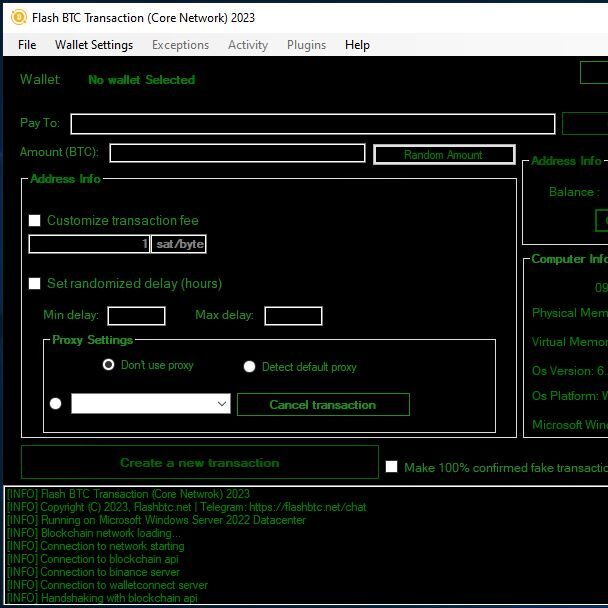

The process of Bitcoin flashing lets you send BTC between wallets through transactions that will eventually become invalid. The system works by manipulating transaction signatures, gas fees, or changing token decimals programmatically. These flash tokens come with some strict limits – you can’t swap or sell them on crypto exchanges because of liquidity issues.

Let’s get into the nuts and bolts of bitcoin flashing software and see what makes it tick. We’ll look at its core parts and the key limits that shape how it runs. Our deep exploration of the transaction structure will show you how these systems handle up to 0.5 BTC in one go, including aspects like transaction confirmation and wallet compatibility.

Understanding Flash BTC Transaction Structure

The foundation of flash BTC transactions lies in payment channels that run alongside Bitcoin’s main blockchain [1]. These channels act as private pathways that let users make multiple transactions without overloading the main network. The software creates a dedicated payment channel between sender and recipient to start a flash transaction [1].

Flash BTC transactions use a special signature mechanism through the Desterilize Signature function that turns byte sequences into digital signatures we can verify [2]. This process checks transaction authenticity by matching signature consistency with calculated hash values. All the same, the system has significant weaknesses in signature parameter checks, especially when you have ‘R’ and ‘S’ values [2].

The transaction’s structure uses multi-signature protocols that work with cold storage systems [3]. The system completes dynamic authorization checks of key holders in an isolated environment through distributed signature verification. This tech setup meets physical isolation needs and achieves permission splitting through key sharing [3].

Each flash transaction has these specific components at the data level:

- A version number that shows transaction features

- Input count that reveals number of source funds

- Output count that shows destination addresses

- Locktime parameter that controls transaction timing [4]

These transactions use an 8-byte format for the amount field, which supports values up to 18,446,744,073,709,551,615 satoshis per output [4]. The system also includes a witness field to unlock inputs with P2WPKH, P2WSH, or P2TR locking scripts [4].

Flash BTC software handles transactions off-chain in specialized payment channels [5]. The transferred BTC works like a debit account balance for instant transactions until the payment channel closes [5]. The final balance then gets recorded on Bitcoin’s main blockchain ledger [5].

Transaction validation needs proper blockchain network confirmation [6]. The system makes use of smart contracts to ensure borrowed funds come back within the same transaction cycle [6]. This setup allows complex financial operations in the decentralized finance ecosystem while keeping transaction integrity intact [6].

Core Components of Flash BTC Software

Flash BTC software works through a sophisticated mix of core components that make Bitcoin transactions possible on the network. The software employs Bitcoin Core’s consensus rules to confirm and process transactions [7].

A transaction verification system gets into blockchain addresses before any transfers begin [8]. This process will give a green light only to valid transactions on the network. The system then uses specialized algorithms to accelerate transaction processing times [9].

The software knows how to handle multiple Bitcoin variants, such as Bitcoin Fantom and Wrapped Bitcoin [10]. The transaction processing mechanism works in several key stages:

- Transaction Initiation: Users input transaction details through the interface

- Verification Protocol: The system confirms sufficient funds and transaction validity

- Processing Optimization: Advanced algorithms improve processing efficiency

- Blockchain Confirmation: Transactions receive network validation

- Completion Phase: Recipients receive confirmed transactions [9]

The software’s architecture has FlashVM, which serves as a computational engine with two main layers [11]:

- Settlement Layer: Manages Bitcoin’s security and transaction finality

- Validator Layer: Handles transaction computation and verification

FlashScript makes permission less asset creation possible on the Bitcoin network [12]. This component works with Bridge Script technology and employs MAST (Merkle Abstract Syntax Trees) and threshold signatures to improve security [11].

The software supports Bitcoin address formats of all types, including Segwit, legacy, and Bech32 [13]. Users can define blockchain network charges to accelerate confirmations through specialized features for managing transaction fees [8].

A crucial component is the consensus mechanism that confirms transactions through individual software nodes that follow similar rules [7]. This decentralized approach makes security stronger by enforcing Bitcoin’s protocols against potential vulnerabilities.

The system has portfolio management features and uses reliable security measures to protect user assets [14]. These interconnected components help maintain transaction integrity within the Bitcoin ecosystem.

Technical Limitations and Constraints

Technical constraints in Bitcoin’s blockchain architecture affect flash BTC software operations in several ways. The network can process only 2,500 to 3,000 transactions per block due to its 1-megabyte block size limit [15]. This results in processing speeds of 7-10 transactions per second [15].

Time-based restrictions strictly govern flash BTC transactions. The flash bitcoins vanish from wallets after 60 to 120 days, based on license type [16]. Any cryptocurrency obtained through these conversions also disappears [4].

Users can transfer flash BTC only 12 times between wallets [4]. This limit applies to wallets of all types, including Binance, Trust Wallet, and blockchain wallets [17].

Transaction values determine confirmation requirements:

- One confirmation for transactions under USD 1,000

- Three confirmations for payments between USD 1,000 – USD 10,000

- Six or more confirmations for transactions over USD 10,000 [18]

Network congestion substantially affects processing times. Users face extended confirmation times and higher transaction fees during busy periods [19]. Scalability challenges emerge from fixed block sizes combined with the 10-minute block interval [19].

Security risks arise from the Vector76 attack mechanism in flash BTC software. This vulnerability exploits confirmation delays across the Bitcoin network [20]. The software implements these security measures to alleviate risks:

- Higher confirmation requirements

- Better transaction pattern monitoring

- Stronger consensus mechanisms [20]

The software works with multiple wallet types like P2PKH, P2SH, P2WPKH, and P2WSH [17]. In spite of that, transaction sizes remain limited to 400 kBs for Segwit and 100 kBs for legacy transactions [5]. The OP_RETURN data size stays restricted to 80 bytes per transaction [5].

Conclusion

Flash BTC software is a complex system that works with Bitcoin’s blockchain architecture. The software uses specialized payment channels and multi-signature protocols to create temporary Bitcoin transactions that last up to 120 days.

The software’s technical aspects are crucial. Transaction structures use Desterilize Signature functions while the Flash VM computational engine handles advanced processing. Every part serves a specific purpose – from verifying signatures to managing different Bitcoin address formats.

The software operates within specific limits. Block sizes allow only 7-10 transactions per second, and users can move funds between 12 wallets at most. Large value transfers need six or more confirmations, while smaller ones require just one.

Strong security features guard against issues like the Vector76 attack through improved monitoring and better consensus mechanisms. These safeguards work alongside standard rules that limit transaction sizes to keep the system secure.

Anyone who wants to learn about this technology can buy the software at https://realflashbtc.net and try these features themselves. The software’s design shows how technological innovation and security requirements can work together, revealing both the possibilities and limits of flash Bitcoin transactions.

FAQs

Q1. What exactly is Flash BTC software? Flash BTC software is a specialized system that enables temporary Bitcoin transactions lasting up to 120 days by manipulating transaction signatures and utilizing payment channels parallel to the main blockchain.

Q2. How does Flash BTC software differ from regular Bitcoin transactions? Unlike regular Bitcoin transactions, Flash BTC transactions operate through dedicated payment channels, allowing multiple transactions without congesting the main network. They also employ unique signature mechanisms and multi-signature protocols for processing.

Q3. What are the key components of Flash BTC software? The core components include a transaction generator module, network communication layer, blockchain interface components, and specialized features like FlashVM for computation and FlashScript for asset creation on the Bitcoin network.

Q4. Are there any limitations to using Flash BTC software? Yes, there are several limitations. Transactions are restricted to a maximum of 12 transfers between wallets, and the software can only process up to 0.5 BTC in a single transaction. Additionally, flash bitcoins automatically disappear after 60-120 days.

Q5. How secure are Flash BTC transactions? While Flash BTC software implements various security measures, including enhanced transaction pattern monitoring and strengthened consensus mechanisms, it’s important to note that these transactions are temporary and cannot be swapped or sold on cryptocurrency exchanges due to liquidity constraints.

One thought on “How Flash BTC Software Actually Works: A Technical Breakdown”