Flash Bitcoin: Did you know that cryptocurrency scams resulted in losses of over $3.3 billion in 2022 alone?

The crypto market continues to attract investors worldwide, but with this growth comes an increasing number of sophisticated threats. These threats pose significant risks to both experienced traders and newcomers who might not recognize the warning signs of potential fraud.

Flash bitcoin represents one of these emerging challenges in cryptocurrency trading. This fast-paced transaction method has become a target for scammers who exploit its speed and complexity to deceive unsuspecting users. This comprehensive guide examines flash bitcoin technology, common scam techniques, security measures, and legal frameworks to help you protect your digital assets. You will learn:

- How flash transactions work and differ from standard bitcoin operations

- Ways to identify and avoid common scam techniques

- Essential security practices for protecting your investments

- Legal resources and reporting mechanisms for fraud cases

Understanding Flash Bitcoin Technology

Flash Bitcoin technology represents a significant departure from traditional cryptocurrency transaction methods, operating outside the conventional blockchain framework [1]. This innovative approach to Bitcoin transactions has garnered attention in the crypto market for its unique characteristics and potential implications.

Technical Definition and Mechanics

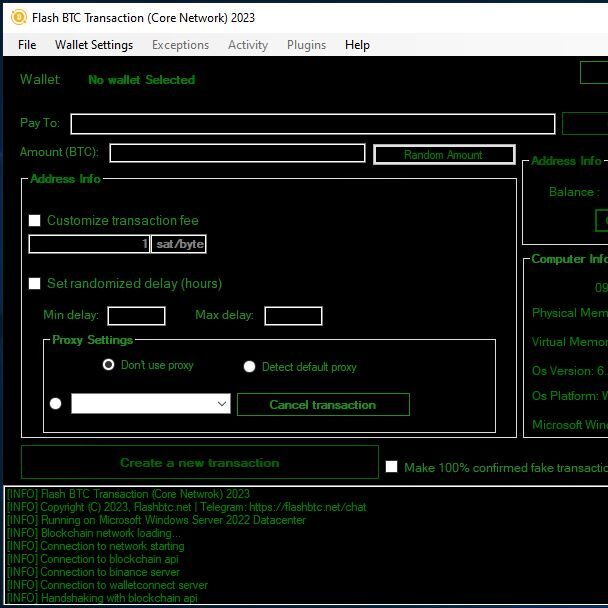

Flash Bitcoin refers to a process where transactions occur off the blockchain, enabling near-instantaneous transfers without requiring standard network confirmations [2]. The system operates through a specialized mechanism that creates private keys associated with pre-existing Bitcoin amounts within a wallet [3]. These transactions utilize specific tools and activation codes, known as ‘flashbtc activation codes’ or ‘coinceller activation codes’, to facilitate rapid transfers [4].

How Flash Transactions Work on the Blockchain

The fundamental operation of Flash Bitcoin differs significantly from traditional methods. While regular Bitcoin networks process approximately 4-4.5 transactions per second [5], Flash BTC transactions operate at considerably higher speeds by bypassing the standard blockchain verification process. The system works through:

- Off-chain transaction processing

- Specialized activation codes

- Instant execution without mining verification

- Direct wallet-to-wallet transfers

Differences from Standard Bitcoin Transactions

The distinction between Flash Bitcoin and traditional transactions becomes clear when examining their core characteristics:

| Feature | Standard Bitcoin | Flash Bitcoin |

|---|---|---|

| Confirmation Time | ~10 minutes [6] | Near instant [7] |

| Network Validation | Required | Bypassed |

| Transaction Type | On-chain | Off-chain |

| Processing Method | Miner verification | Direct transfer |

It’s crucial to understand that while Flash Bitcoin transactions appear to offer advantages in terms of speed, they operate outside the traditional security framework of the blockchain. These transactions can remain visible in the network for varying periods, with some implementations claiming visibility of up to 60-120 days [8]. However, this technology’s operation outside standard blockchain protocols introduces unique considerations for transaction security and validation.

The mechanics behind Flash Bitcoin involve creating temporary transaction states that may not have the same permanence as traditional blockchain entries [1]. This characteristic makes the technology particularly noteworthy in the context of the broader crypto market, as it represents both technological innovation and potential security considerations that users must carefully evaluate.

Common Flash Bitcoin Scam Techniques

The crypto market has witnessed a surge in sophisticated scam techniques, with flash bitcoin schemes becoming increasingly prevalent. According to reports, over $2 billion worth of cryptocurrencies were lost to various scams in just the first half of 2022 [2].

Double-Spending Exploitation Methods

Double-spending represents one of the most technically sophisticated attacks in flash bitcoin scams. This technique involves fraudsters attempting to spend the same cryptocurrency multiple times by manipulating transaction timing [3]. The process typically begins with scammers creating multiple buy-and-sell orders to artificially inflate demand [4].

Fake Transaction Confirmation Tricks

Scammers employ various deceptive methods to create the illusion of legitimate transactions. A common technique involves sending flash coins that initially appear in the recipient’s wallet but disappear after a short period [5]. These transactions often show zero or minimal confirmations, making them particularly dangerous for inexperienced traders. According to security reports, transactions involving amounts between $1,000 and $10,000 should wait for at least three confirmations to ensure legitimacy [6].

Social Engineering Tactics in Flash Scams

Social engineering has emerged as a primary vector for flash bitcoin scams, with attacks increasing by 170% in Q2 2022 [7]. These attacks typically manifest through:

Common Manipulation Techniques:

- Impersonation of legitimate entities

- Creation of artificial urgency

- Exploitation of FOMO (Fear of Missing Out)

- Use of sophisticated phishing methods

The effectiveness of these scams often relies on exploiting human psychology rather than technical vulnerabilities [8]. Scammers frequently utilize peer-to-peer trading platforms, where they can directly interact with potential victims [1]. They might start with small transactions to build trust before attempting larger fraudulent transfers.

To protect against these threats, experts recommend implementing a verification process that includes checking transaction hashes and using blockchain explorers to validate transfers [2]. For transactions exceeding $10,000, waiting for at least four confirmations is considered essential to ensure security [3].

Transaction Verification and Security

Understanding transaction verification is crucial for securing your investments in the crypto market. The blockchain confirmation process serves as the foundation of cryptocurrency security, ensuring transaction legitimacy and preventing fraud.

Blockchain Confirmation Process

When a transaction is initiated, it enters a pool of unconfirmed transactions waiting to be verified by miners [4]. The verification process involves miners selecting transactions and placing them into blocks through a proof-of-work system. Each new block added to the blockchain represents an additional confirmation for your transaction [5]. This process creates a mathematical connection between blocks, making it increasingly difficult to alter previous transactions [6].

Minimum Confirmation Requirements

Different transaction amounts require varying levels of confirmation for optimal security:

| Transaction Amount | Recommended Confirmations | Average Time |

|---|---|---|

| Under $1,000 | 1-2 confirmations | 10-20 minutes [7] |

| $1,000-$10,000 | 3 confirmations | 30 minutes [8] |

| $10,000-$1,000,000 | 6 confirmations | 60 minutes [1] |

| Over $1,000,000 | 12+ confirmations | 120+ minutes [2] |

Most cryptocurrency exchanges require a minimum of three confirmations for deposits [3], while some platforms have recently reduced requirements to two confirmations for faster processing [4].

Network Validation Mechanisms

The Bitcoin network employs robust validation mechanisms to ensure transaction security:

- Block Verification: Each block undergoes thorough validation by network nodes before acceptance [5]

- Proof-of-Work System: Miners must solve complex mathematical puzzles, requiring significant computational power [6]

- Network Consensus: Multiple nodes must verify and agree on transaction validity [7]

The validation process targets a 10-minute interval between blocks, though actual times may vary based on network conditions [8]. This systematic approach ensures that by the sixth confirmation, the probability of a transaction being reversed becomes mathematically negligible, approximately one in a billion [1].

For enhanced security, transactions utilize the XSalsa20 algorithm for data encryption [2], providing additional protection for sensitive information during the verification process. The decentralized nature of blockchain validation means that altering confirmed transactions would require an almost impossible amount of computing power [3].

Protecting Your Digital Assets

Securing your assets in the crypto market requires a multi-layered approach that combines robust security measures with vigilant monitoring. As digital threats evolve, implementing comprehensive protection strategies becomes increasingly crucial.

Wallet Security Best Practices

The foundation of cryptocurrency security lies in proper wallet management. Hardware wallets provide the highest level of security by keeping private keys offline and encrypted [4]. For maximum protection, experts recommend implementing a dual-storage strategy:

Primary Security Measures:

- Use cold storage for long-term holdings [5]

- Enable strong encryption with minimum 16-character passwords [6]

- Implement multi-signature authentication for high-value transactions [7]

For enhanced protection, consider distributing assets across multiple wallets based on their purpose and value [8]. This strategy helps minimize potential losses if one wallet becomes compromised.

Transaction Verification Tools

Transaction verification tools serve as your first line of defense against fraudulent activities. Modern wallet security systems incorporate several layers of protection:

| Security Level | Verification Method | Implementation |

|---|---|---|

| Basic | Two-factor authentication | Mobile authenticator apps |

| Advanced | Multi-signature verification | Multiple key holders |

| Premium | Hardware security modules | Physical verification devices |

These tools can detect suspicious activities and prevent unauthorized transfers, with some platforms offering real-time monitoring capabilities [1]. Regular verification of transaction logs helps identify potential security breaches early.

Emergency Response Procedures

In case of a security breach, time is critical. A well-planned emergency response protocol should include:

Immediate Actions:

- Freeze affected accounts immediately [2]

- Document all suspicious activities

- Contact relevant security teams

Recovery Steps:

- Activate backup recovery phrases [3]

- Transfer remaining assets to secure wallets

- Enable additional security measures

For institutional users, establishing an incident response team with clearly defined roles can significantly reduce response time during emergencies [4]. This team should conduct regular drills and maintain updated security protocols to address evolving threats in the crypto market.

Remember to regularly update wallet software and maintain offline backups of critical security information [5]. In the event of suspicious activity, having proper documentation and following established procedures can help minimize potential losses and facilitate faster recovery.

Legal and Regulatory Framework

The regulatory landscape for cryptocurrency continues to evolve rapidly, with governments worldwide implementing new frameworks to protect investors and combat fraud. According to recent data, among 60 studied countries, cryptocurrency is fully legal in 33 nations, partially banned in 17, and generally banned in 10 [6].

Current Regulatory Status

The crypto market’s regulatory environment remains dynamic, with 70% of reviewed countries actively making substantial changes to their frameworks [7]. In the United States, multiple agencies oversee different aspects of cryptocurrency:

| Agency | Primary Focus | Jurisdiction |

|---|---|---|

| SEC | Securities Oversight | Investment Products |

| CFTC | Commodities Trading | Derivatives Markets |

| FinCEN | Financial Crime | Money Transmission |

Notably, twelve G20 countries, representing over 57% of the world’s GDP, have established full legal frameworks for cryptocurrencies [8]. This demonstrates growing acceptance while emphasizing the need for robust regulation.

Legal Implications for Victims

Victims of cryptocurrency fraud face unique challenges in recovering their assets. Between February 2023 and February 2024, victims who were further exploited by fictitious law firms reported losses totaling over $9.90 million [1]. Important legal considerations include:

- Immediate reporting requirements

- Documentation of all transactions

- Preservation of communication records

- Compliance with regulatory guidelines

The Department of Justice has established a National Cryptocurrency Enforcement Team to investigate and prosecute criminal misuse of cryptocurrencies [2]. This development strengthens the legal framework for victim protection and asset recovery.

Reporting Mechanisms and Resources

For victims of cryptocurrency fraud, several reporting channels are available. The FBI’s Internet Crime Complaint Center (IC3) serves as the primary reporting mechanism [3]. When filing a report, include:

Transaction Details:

- Cryptocurrency addresses

- Amount and type of cryptocurrency

- Transaction ID (hash)

- Date and time of occurrence

Supporting Information:

- Communications with suspected scammers

- Website addresses or applications used

- Two-factor authentication details

- Exchange platform information

Warning: Be cautious of recovery services claiming they can retrieve lost funds, as this often leads to secondary scams [4]. The FBI emphasizes that legitimate law enforcement agencies never charge victims for investigating crimes [5].

For enhanced protection, regulators expect boards to establish clear directives regarding strategy and risk appetite, ensuring sufficient scope and detail for sound decision-making [6]. This regulatory oversight extends to both traditional financial institutions and cryptocurrency service providers, creating a more secure environment for legitimate transactions in the crypto market.

Conclusion

Flash Bitcoin technology presents both opportunities and significant risks in today’s cryptocurrency landscape. This comprehensive guide has highlighted critical aspects of flash transactions, from their technical operation outside traditional blockchain frameworks to sophisticated scam techniques that threaten digital assets.

Security remains paramount when dealing with flash bitcoin transactions. Proper verification processes, including multiple confirmations based on transaction size, serve as essential safeguards against potential fraud. Hardware wallets, multi-signature authentication, and robust emergency response procedures create strong defensive layers for protecting digital investments.

The regulatory environment continues maturing, offering increased protection through agencies like the SEC, CFTC, and FinCEN. These organizations work alongside law enforcement to combat cryptocurrency fraud and provide recovery mechanisms for victims.

Key Takeaways

- Understanding flash transaction mechanics and their differences from standard operations

- Recognizing common scam techniques, particularly double-spending and social engineering

- Implementing proper security measures through wallet management and verification tools

- Knowing available legal resources and reporting channels for fraud cases

Cryptocurrency security demands constant vigilance and education. Armed with this knowledge about flash bitcoin operations, security protocols, and regulatory frameworks, traders can better protect their digital assets while participating in the crypto market.

For those interested in exploring Flash Bitcoin technology further, including obtaining the necessary software, visit www.realflashbtc.net. This resource provides comprehensive information and tools to help you navigate the complexities of Flash Bitcoin transactions securely.

References

[1] – https://realflashbtc.net/articles/2024/08/07/flash-bitcoin-software/

[2] – https://realflashbtc.net/articles/2024/08/08/flash-btc-explained-in-depth-guide-to-the-cryptocurrency/

[3] – https://realflashbtc.net/articles/2024/08/09/is-flash-bitcoin-tradable/

[4] – https://realflashbtc.net/articles/2024/08/10/how-to-use-flash-btc-a-complete-guidance-for-beginners/

[5] – https://realflashbtc.net/articles/2024/08/12/flash-btc-vs-cryptocurrencies-speed-security-usability/

[6] – https://realflashbtc.net/articles/2024/08/14/flash-btc-software-2024/

[7] – https://realflashbtc.net/articles/2024/08/15/understanding-btc-flash-transactions-usdt-comparison/

[8] – https://realflashbtc.net/articles/2024/12/03/how-to-execute-a-flash-btc-transaction-a-step-by-step-guide/

2 thoughts on “Flash Bitcoin and Cryptocurrency Guide”