BTC flashing signals have grabbed crypto traders’ attention after BTC dropped 11% from its all-time high recently. This pattern looks familiar and deserves our attention. Bitcoin showed a bearish divergence before hitting $69,000 in 2021, followed by a steep fall to approximately $15,500 by November 2022.

The Market Value to Realized Value (MVRV) Momentum indicator makes these bitcoin signals especially concerning, as it just showed a death cross signal. Bearish reversals often follow when the indicator’s short-term moving average drops below its long-term moving average. BTC flash transactions complete in about ten minutes, but this warning could point to broader market shifts ahead. Bitcoin trades at $109,432 now, with crucial support levels at $104,520, $97,050, and $59,720 that require close monitoring.

What Is BTC Flashing and Why It Matters

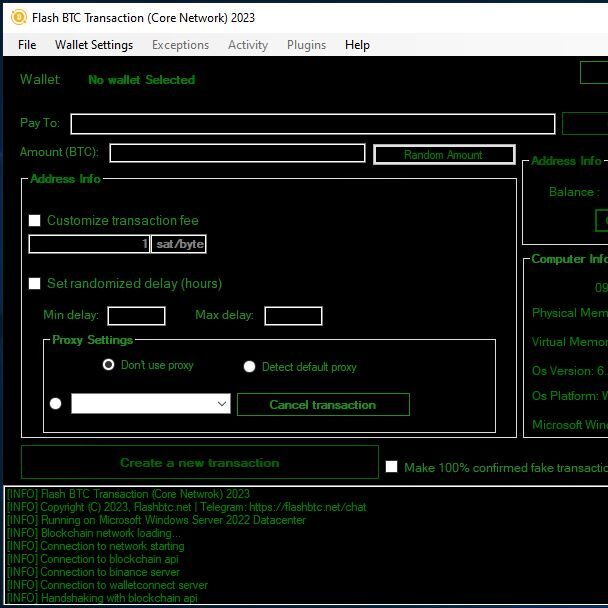

You need to learn about BTC flashing to protect yourself from cryptocurrency scams. BTC flashing happens when Bitcoin shows up in your wallet and disappears quickly. Scammers use this trick to make you think a payment went through, even though the blockchain never confirmed it.

The way flash BTC works is simple but risky. Bitcoin transactions first go into a pool of unconfirmed transactions called the mempool. Scammers take advantage of this waiting period and send Bitcoin that hasn’t been confirmed. The coins show up in your wallet right away, so you think you got paid. The scammer then sends those same coins to their own wallet with a higher fee. So miners pick their transaction over yours, and your coins vanish.

This matters because real Bitcoin transactions need the blockchain network’s confirmation, which usually takes about ten minutes. Flash coins skip this important security step. New traders who don’t know how confirmations work are especially at risk.

Platforms like realflashbtc.net help you spot these suspicious transactions and stay safe. Note that Bitcoin payments become secure only after one confirmation. Experts suggest waiting for six confirmations with large transactions.

The Hidden Signal: How Flash BTC Can Predict Market Moves

Technical analysts look beyond the obvious patterns when trading Bitcoin. Flash BTC signals are legitimate market indicators that warn traders before major price movements, unlike the scam techniques mentioned earlier.

The MVRV (Market Value to Realized Value) ratio is a powerful market predictor. This indicator produced a bearish “death cross” recently and signaled weakening momentum [1]. This pattern preceded the 2021 cycle top before Bitcoin dropped 77% from $69,000 to $15,500 [1]. The MVRV Z-Score sits around 2, which is nowhere near the danger zone of 7-9 seen at previous cycle peaks [1].

Divergence patterns give traders valuable market insights. A warning signal appears when Bitcoin’s price rises while momentum indicators decline [2]. This exact scenario played out in May before Bitcoin reached $111,800 and later dipped below $100,000 [2].

The May 19, 2021 flash crash serves as a stark reminder when Bitcoin plunged 30% [3]. Some exchanges allegedly manipulated data during this crash, with evidence pointing to backfilled transactions that violated mathematical principles [3].

The UTXO Realized Price Distribution (URPD) tool helps identify price ranges where substantial Bitcoin accumulation happened [4]. Strong support exists between $104,520 and $108,000 currently [5].

Traders who want legitimate flash BTC analysis tools can head over to realflashbtc.net. The platform monitors these hidden signals professionally and helps spot potential market reversals early.

How to Identify and Respond to Flash BTC Events

Image Source: Breet

You need watchfulness and proper verification techniques to stay safe from flash BTC events. Cryptocurrency flash crashes happen when many holders sell at once, making prices drop faster within a short time period [6]. These differ from regular crashes because prices bounce back faster, usually close to their original levels.

Bitcoin transactions have clear signs that help spot genuine ones. Let me share what I always check.

Blockchain explorers like Blockchain.com [7] should be your first stop to verify transactions. Real transactions show up in the mempool before confirmation, but flash transactions usually skip this crucial step [8]. Any transaction showing zero confirmations hasn’t made it into a block yet. Accepting these payments puts you at risk of double-spend attacks [9].

The number of confirmations matters a lot. Expert advice says you should wait for at least 6 confirmations (about an hour) before a transaction becomes irreversible [10]. One confirmation might be enough for smaller amounts.

Watch out for transactions that look good at first but vanish shortly after [8]. Scammers love this trick in flash BTC scams.

Smart responses mean never sending money to “unlock” or “release” other assets—that’s a huge warning sign. The software at realflashbtc.net helps spot genuine tools through their complete 7-step verification process [11].

Conclusion

BTC flashing poses a major threat but also creates chances for crypto traders. This piece looks at how flash BTC shows up either as deceptive scams or genuine market indicators that point to possible price shifts.

Every Bitcoin trader needs to understand these signals clearly. The latest MVRV death cross pattern shows how market conditions can shift faster, especially when technical indicators warn us about big price corrections. Your investment portfolio could face huge losses if you miss these hidden signals.

You need several verification steps to guard against flash BTC scams. You should verify transaction confirmations, use trusted blockchain explorers, and avoid zero-confirmation transactions with large amounts. On top of that, genuine transactions show up in the mempool before confirmation, unlike flash scams that skip this step.

realflashbtc.net provides complete tools to spot genuine transactions and market signals, helping traders who want reliable protection and analysis. Their 7-step verification process filters out scams while their professional monitoring helps detect market reversals early.

These warning signals need your attention as Bitcoin trades near all-time highs. Past flash crashes have dropped Bitcoin’s value by 30% or more in just one day. Without doubt, proper education and verification tools from trusted sources like realflashbtc.net help protect you from market swings and scam attempts.

Your financial security depends on spotting these signals before markets react. The right knowledge and tools will help you direct your path through Bitcoin trading with better confidence and security.

FAQs

Q1. What is BTC flashing and why is it important? Bitcoin flashing refers to a technique where Bitcoin appears momentarily in a wallet but disappears shortly after. It’s important because it can be used deceptively to create an illusion of payment completion without actual blockchain confirmation, potentially leading to scams.

Q2. How can I protect myself from flash BTC scams? To protect yourself, always verify transactions through multiple blockchain explorers, wait for at least 6 confirmations for large transactions, and be wary of transactions that initially appear successful but disappear shortly after. Never send funds to “unlock” or “release” other assets.

Q3. What is the MVRV ratio and how does it relate to Bitcoin trading? The MVRV (Market Value to Realized Value) ratio is a technical indicator used in Bitcoin trading. A bearish “death cross” in this indicator can signal waning momentum and potentially predict major price movements in the market.

Q4. How long should I wait for a Bitcoin transaction to be confirmed? Experts recommend waiting for at least 6 confirmations (approximately one hour) for transactions to be considered irreversible. For smaller amounts, a single confirmation might suffice, but it’s always safer to wait for multiple confirmations.

Q5. What tools can help identify genuine Bitcoin transactions and market signals? Platforms like realflashbtc.net offer specialized software and tools to help identify genuine transactions through a complete 7-step verification process. They also provide professional monitoring services to spot potential market reversals before they occur.

References

[1] – https://realflashbtc.net/articles/2025/05/19/flash-btc-software-exposed-truth-behind-bitcoin-transaction-multipliers/

[2] – https://realflashbtc.net/articles/2025/08/29/how-to-verify-authentic-flash-bitcoin-software-2025/

2 thoughts on “BTC Flashing Explained: 2025 Special Updates”