Flash loan attacks in crypto can process millions of dollars in borrowed funds within seconds without any collateral – a fact that might surprise you.

Traditional loans need collateral and credit checks, but flash loans work in a completely different way. The decentralized finance (DeFi) ecosystem allows these uncollateralized loans where users can borrow and return assets within the same blockchain transaction. Traders who want to protect their investments should understand how flash loan attacks work. The system automatically reverses the entire process if borrowers fail to repay the loan within that same transaction.

This complete guide explains flash loan attacks, their mechanisms, and ways to identify and prevent them. You’ll learn about the legitimate uses of flash loans in crypto and understand their potential security risks. We’ll answer your questions about the legality of flash loan attacks and help you grasp the concept better.

Let’s take a closer look at flash loans and give you the knowledge to handle this complex aspect of cryptocurrency trading safely.

Setting Up for a Flash Loan Attack

A secure wallet setup marks your first step to grasp flash loan attacks. You need a self-custody wallet that gives you full control of your crypto assets. This becomes vital when you work with flash loan transactions.

Your journey starts with a trusted wallet app download. The setup flows in a clear sequence. Pick “Create New Wallet” after installation and secure your 12-word recovery phrase right away. This phrase acts as your master key that creates all wallet addresses and private keys.

Here are the must-follow security steps during setup:

- Write your recovery phrase on paper and keep it offline—never in digital format

- Keep your written phrase safe in multiple places like a fireproof safe

- Check the recovery phrase by typing it back in the right order

- Add biometric authentication or passcode protection

Smart users test their recovery process before adding funds to their wallet. This check proves you can get to your assets if your device fails.

RealFlashBTC‘s team suggests using separate wallets just for flash loan operations. This split from your personal holdings adds extra safety against security issues when you run advanced DeFi strategies.

Executing the Flash Loan Transaction

Your secure wallet is ready, and now comes the crucial part – executing the flash loan transaction. Smart contracts make flash loans work through a simple rule: you must borrow and return assets in the same blockchain transaction.

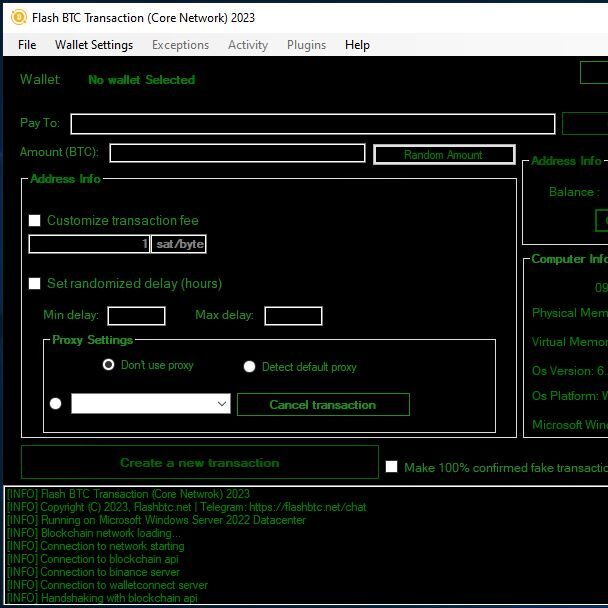

The process starts when your contract calls the Pool contract to request the loan. RealFlashBTC’s platform gives you two methods:

- flashLoanSimple() – You can borrow one type of asset

- flashLoan() – You can perform complex operations with multiple assets

The Pool transfers your requested amounts and calls the executeOperation() function on your contract when execution begins. Your contract gets the borrowed funds and can run any operation in its code.

The way you pay back the loan is different based on the method you chose. The flashLoanSimple method needs you to approve the Pool to take the borrowed amount plus a small fee. The flashLoan method requires either Pool approval or enough collateral to open a debt position.

The transaction automatically reverts if you can’t pay back the loan. This safety feature makes flash loans secure for lenders and allows advanced trading strategies without losing funds permanently.

RealFlashBTC makes this complex process simple and available to users who don’t have much coding experience.

Sending Confirmation and Monetization Steps

Verification is a crucial step that follows every flash loan transaction. RealFlashBTC sends confirmation notifications to users right after processing transactions to maintain security and transparency.

You’ll get a confirmation email once your transaction completes. These notifications need your attention because scammers create fake emails that look like they’re from crypto exchanges. These attackers are clever – they use trusted platforms like Google Forms to get past spam filters and send fake transaction confirmations.

RealFlashBTC keeps users safe with strong verification protocols. Note that a simple rule can protect you: don’t confirm emails unless you’re expecting them. No one can create an account without email confirmation, so avoiding suspicious messages keeps unauthorized users out.

Here’s how to safely make money from your flash loan strategy:

- Verify all confirmation emails come directly from RealFlashBTC’s official domain

- Review transaction details really well before approval

- Ignore messages asking for “commission” payments to receive transfers – it’s a common scam

RealFlashBTC’s security team watches for attackers who create fake submission confirmation emails that look like real notifications. Their advanced system protects your digital assets during the flash loan process from start to finish.

Conclusion

Flash loans are powerful yet complex tools in the cryptocurrency ecosystem. This piece explains how these uncollateralized loans work. Borrowers must complete their transactions in a single blockchain operation, and security is the top priority when you use flash loan mechanisms.

A properly set up self-custody wallet becomes your first defense against threats. RealFlashBTC provides a secure platform that lets you execute these sophisticated transactions without deep coding knowledge. Traders who want to implement flash loan strategies should think over their detailed solutions.

Asset protection depends on verification. Fake confirmation emails are a major threat, and RealFlashBTC uses resilient verification protocols that protect users during the whole ordeal. You should never confirm unexpected emails and check all transaction details before approval.

Flash loans give unique opportunities to traders who grasp both mechanisms and security implications. This information will help you direct flash loan operations safely. The RealFlashBTC platform (https://realflashbtc.net) is your trusted partner to learn these advanced DeFi strategies while you retain control over security standards.

Your financial security depends on understanding flash loans’ potential and risks. Without doubt, this knowledge will be valuable as you continue your cryptocurrency trading experience with confidence.

FAQs

Q1. What is a flash loan in cryptocurrency? A flash loan is a type of uncollateralized loan in decentralized finance (DeFi) where assets are borrowed and returned within the same blockchain transaction. These loans don’t require upfront collateral and are facilitated by smart contracts.

Q2. How do flash loan attacks work? Flash loan attacks exploit vulnerabilities in DeFi protocols. Attackers borrow large amounts of cryptocurrency without collateral, manipulate market prices or exploit contract weaknesses, and then repay the loan in the same transaction, potentially making significant profits.

Q3. Are flash loans legal? While flash loans themselves are a legitimate DeFi tool, their use in attacks or exploits can be illegal. The legality often depends on how they’re used and the specific regulations in different jurisdictions.

Q4. How can traders protect themselves from flash loan attacks? Traders can protect themselves by using reputable platforms, keeping their recovery phrases secure, verifying all transaction details, and being cautious of unexpected confirmation emails. It’s also crucial to understand the mechanics of flash loans and stay informed about potential vulnerabilities.

Q5. What are some legitimate uses for flash loans? Flash loans can be used for arbitrage between different cryptocurrency exchanges, collateral swaps, and self-liquidation to avoid penalties. They also enable users to test trading strategies without risking their own capital, as failed transactions are automatically reversed.

Reference

[1] https://realflashbtc.net/articles/2025/09/02/btc-flashing-explained-2025-special-updates/

[2] https://realflashbtc.net/articles/2025/09/01/how-to-download-flash-btc-software-expert-setup-guide-2025/

[3] https://realflashbtc.net/articles/2025/08/30/flash-coin-exposed-the-ultimate-guide-to-a-lightning-fast-digital-revolution/

[4] https://realflashbtc.net/articles/2025/08/29/how-to-verify-authentic-flash-bitcoin-software-2025/

[5] https://realflashbtc.net/articles/2025/08/28/flash-btc-software-download-understanding-the-scam-and-how-to-protect-yourself/

[6] https://realflashbtc.net/articles/2025/08/27/what-is-flash-crypto/

[7] https://realflashbtc.net/articles/2025/08/19/how-to-buy-flash-btc-software-2025/

[8] https://realflashbtc.net/articles/2025/08/12/bitcoin-flash-software-review-2025/